Creating an even smoother experience for the world’s best travel concierge

With travel insurance sales diminishing, American Express brought us on to take a closer look at the problem. Through a fast and thorough discovery phase, we found the issue, fixed it, and provided a design system that could be used by other teams to increase sales.

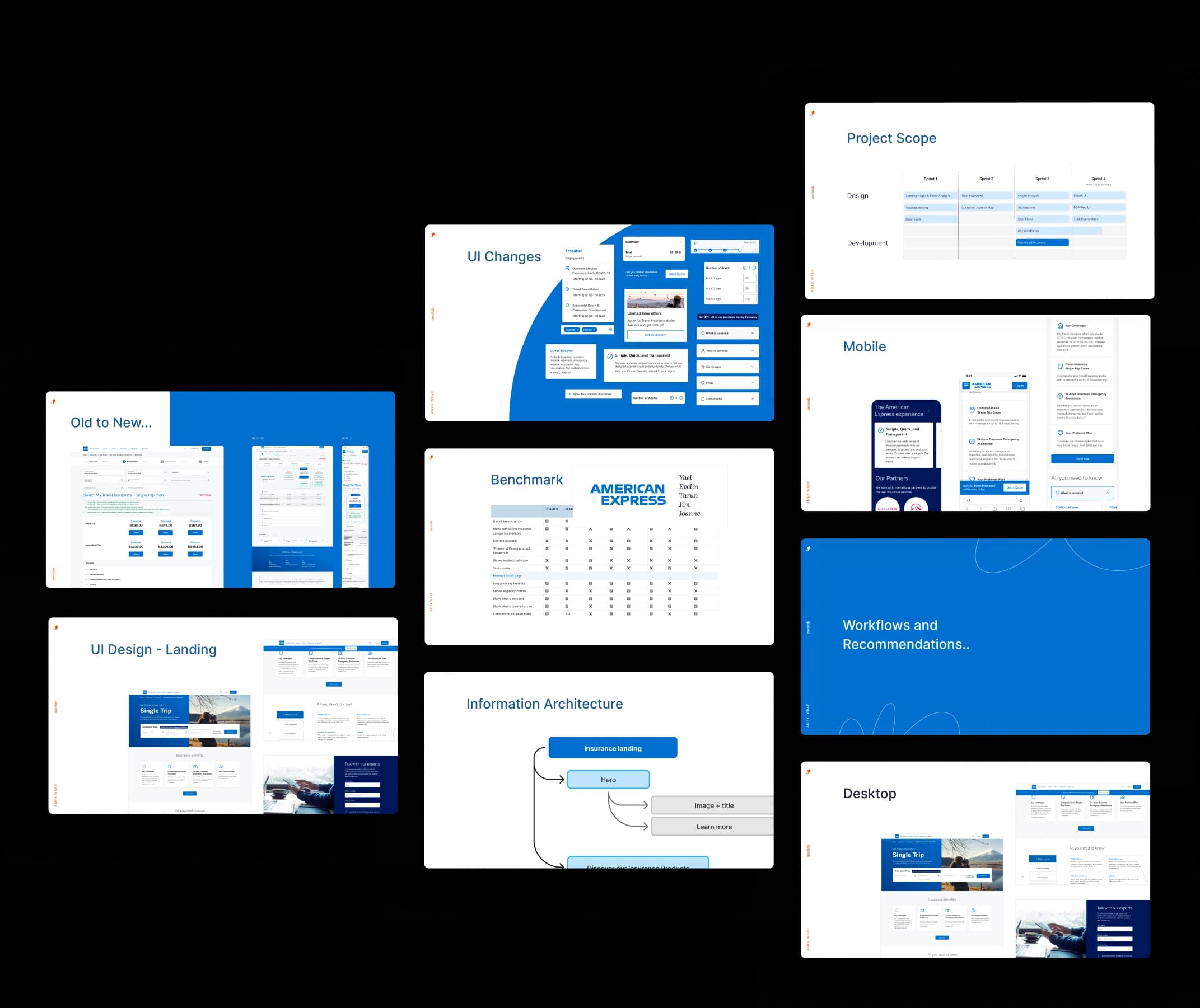

What we did

Platforms

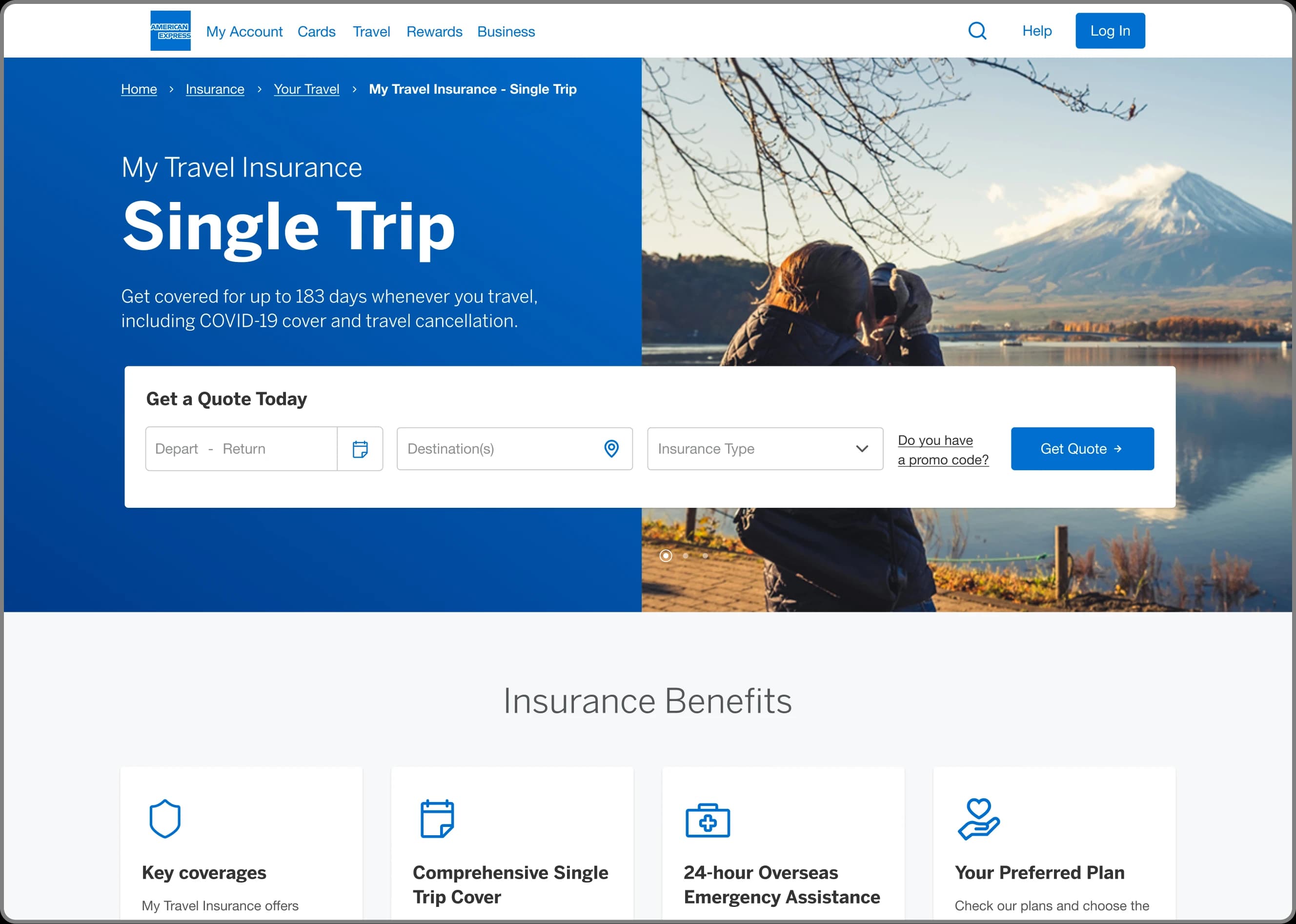

Best-In-Class service

American Express is one of the most recognizable credit cards in the world with transactions totaling over a trillion dollars a year.In addition to booking flights and hotels, AMEX also offers great deals on travel insurance.

Travel insurance sales were down

While customers were interested in getting insurance, they weren’t buying it. Something was off, and it was off in every region — from France to Latin America.

What’s missing?

When conversion rates are low on something customers want to buy, there’s usually a communication problem. Either something was missing on the product offers or in the UI.

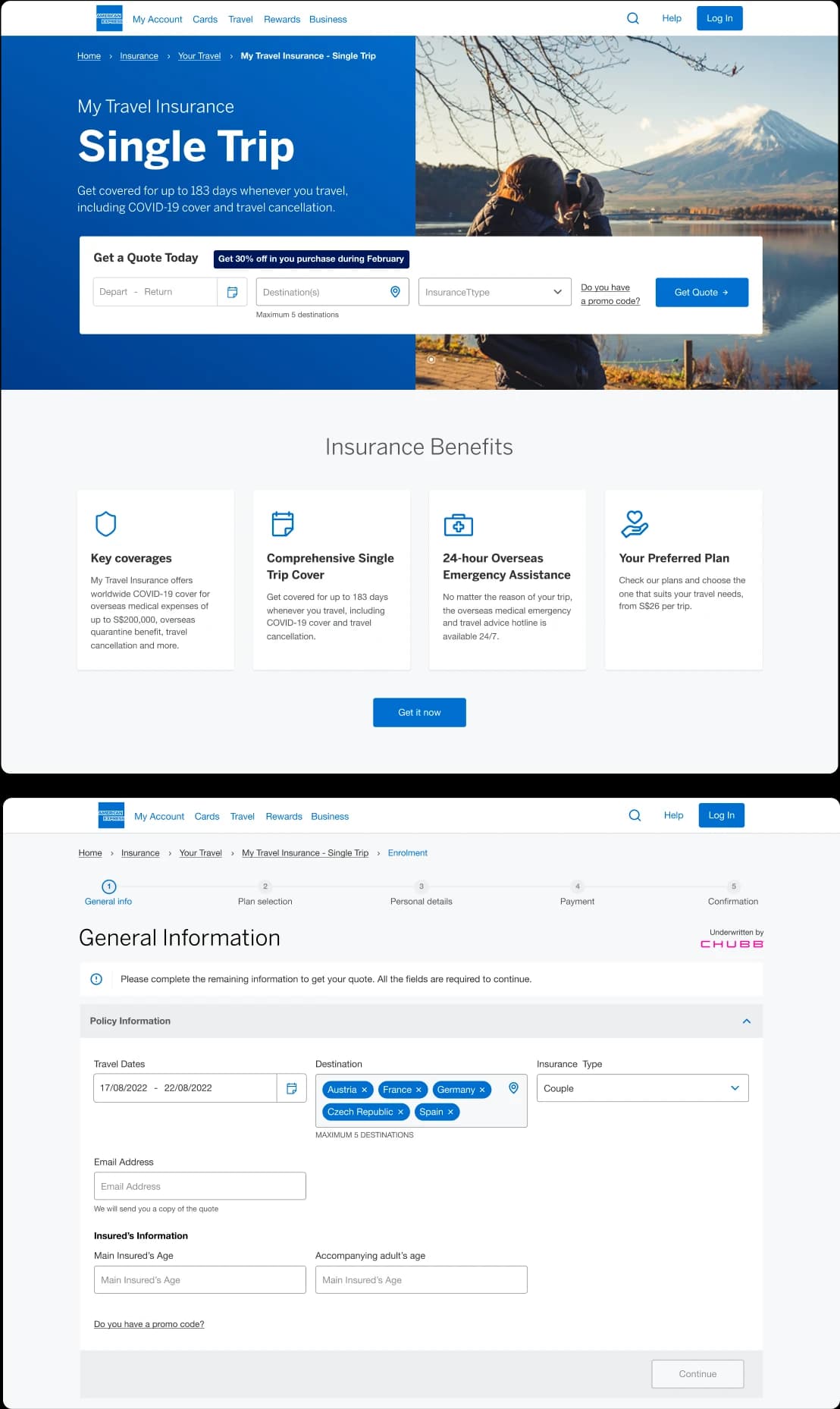

Find the flow

The best way to improve a flow is to start a Discovery process to figure out the issue.

Create a Customer Journey Map, focusing on the key moments where the user interact with the product.

Figure out which steps are causing the most churn by reviewing analytics.

Interview and test with 10+ users to get in-depth insights on their thought process.

Benchmark best-in-class products to find potential improvements.

Troubleshoot those critical steps and creating product hypothesis.

You can usually find and fix the most critical issues in a short time, a sweet spot for most product decisions. And most of those don’t usually require a huge engineering effort — always a plus.

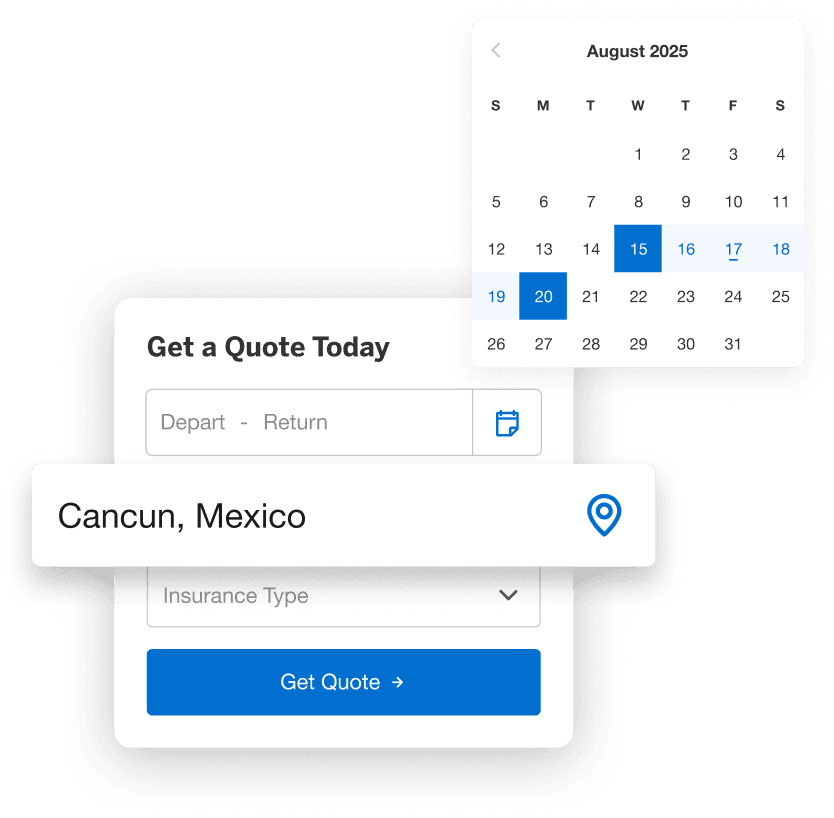

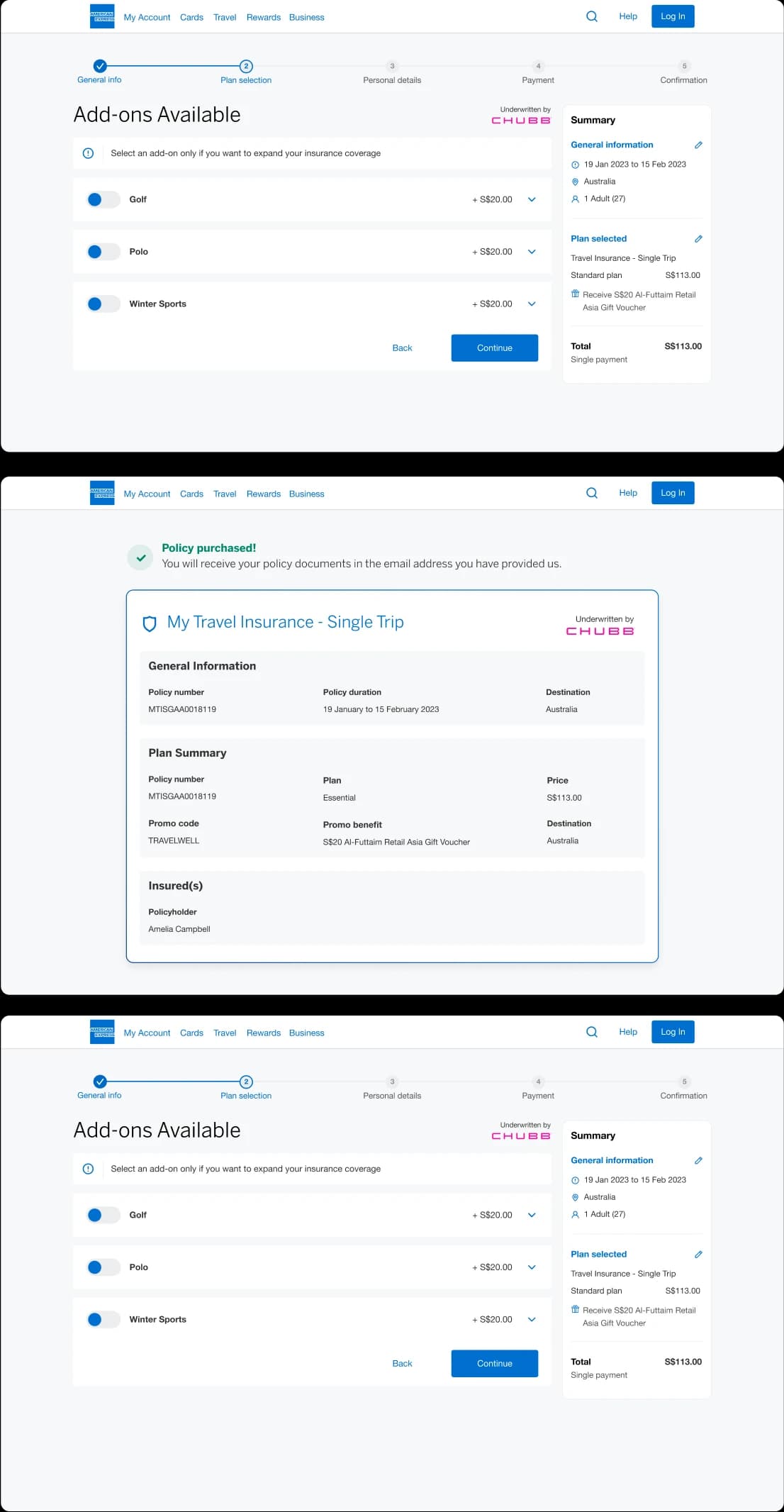

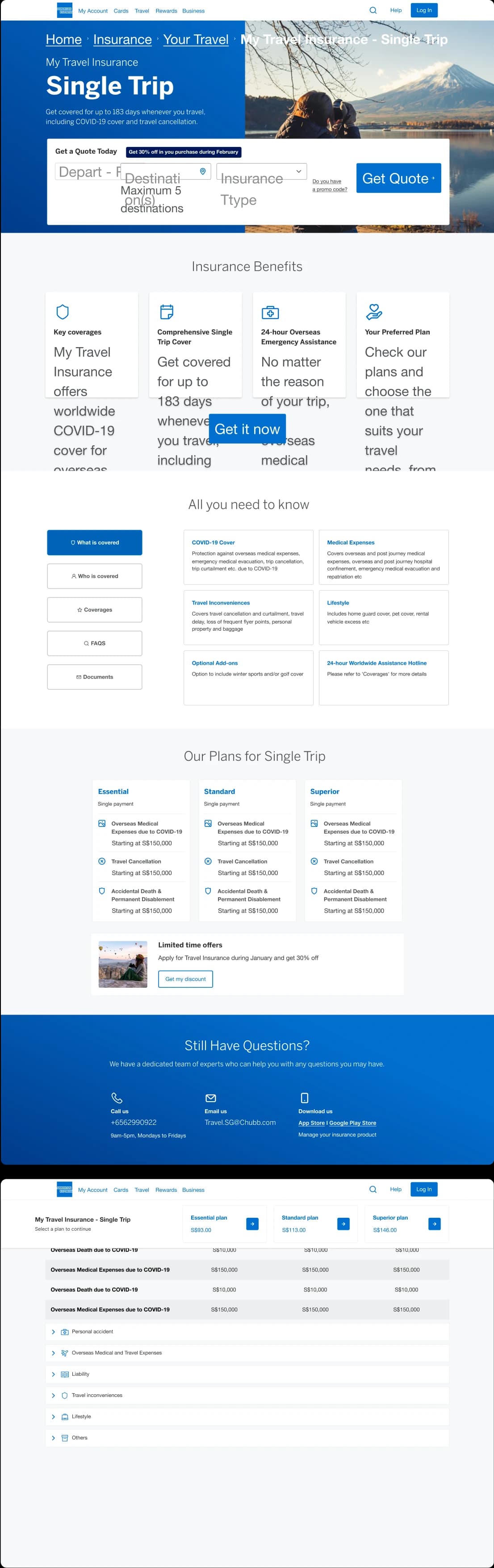

Fewer options, better outcomes

One of the biggest issues we found was that customers didn’t understand what they were buying. Insurance options tend to be complex, and people don’t buy things they don’t understand.

We worked with their insurance team to simplify their offerings from 6 options to just 1 recommendation and a few very clear upsells.

After the redesign they started picking the recommended option and finished the transaction.

That human connection

With global products there’s always a market that behaves unexpectedly. In a few countries, customers outright refuse to buy insurance and similar products online. If there’s no human on the other side, they will not make the purchase.

By pinging the call center to follow up on the purchase, we were able to multiply conversion rates many times over. Just by putting a human on the other side of the screen.

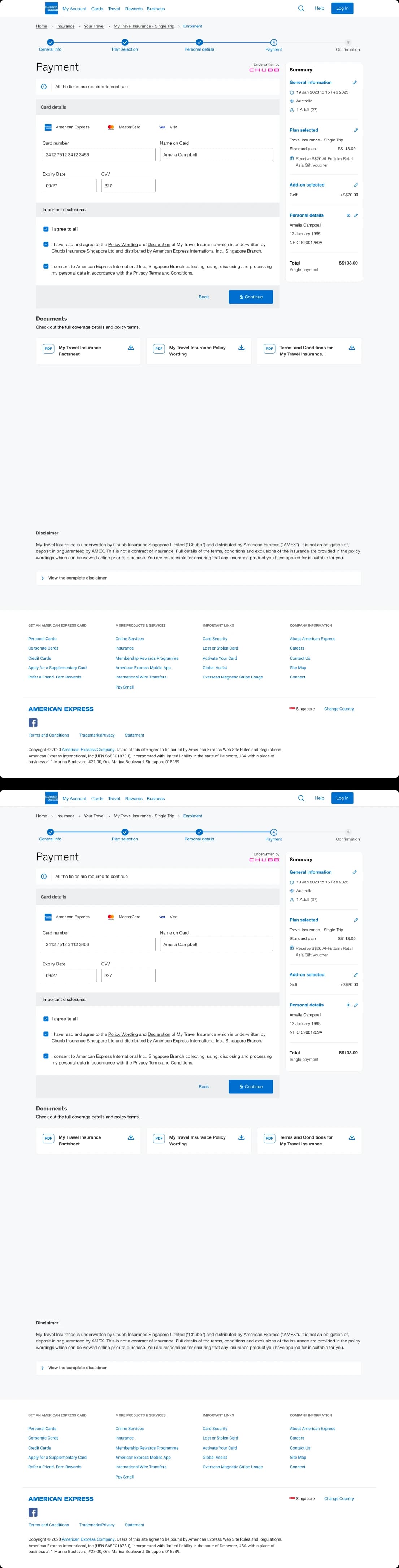

Design the system

To streamline this solution, we built an insurance design system so American Express could implement it across all their products and teams.

Easy to plug in and aligned with the brand guidelines, now verticals all across the company are able to simplify the flow with very little engineering effort.

Big Wins

User experience improvements aimed to dummy textreduce the bounce raterecover lost purchasescomplete purchases fasterfinish purchases faster

Knowledge sharing with global teams

In addition, we created a Wiki explaining all the workflows, insights, recommendations, and suggested conversion and purchase flow improvements.All this is meant to help share these insights and design patterns with other AMEX teams worldwide.